35+ Extra principal mortgage calculator

This loan calculator is written and maintained by Bret Whissel. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages.

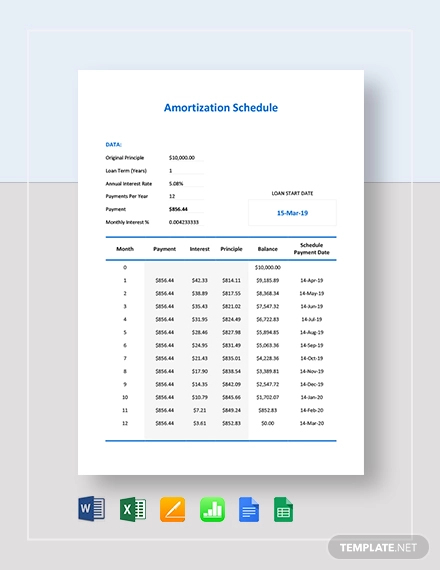

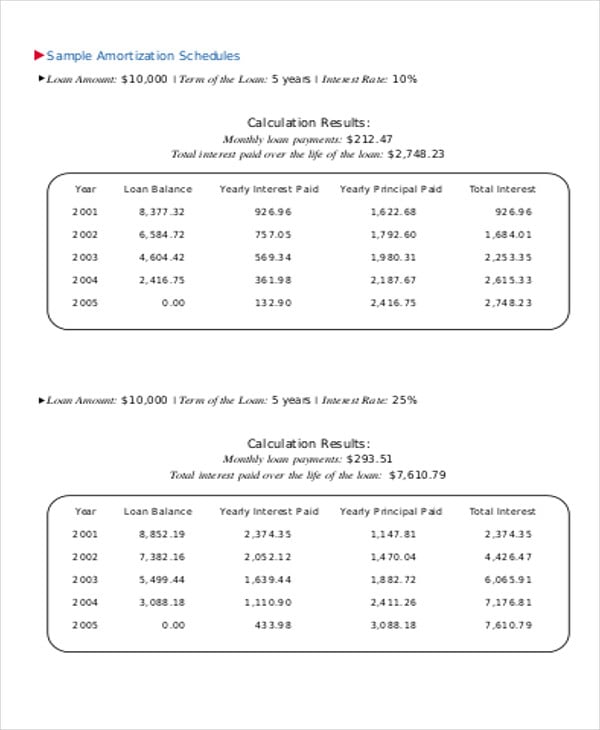

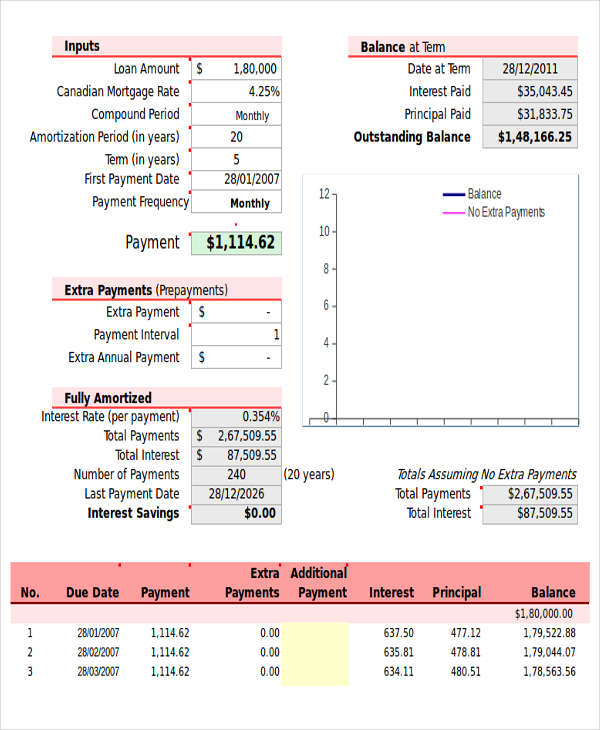

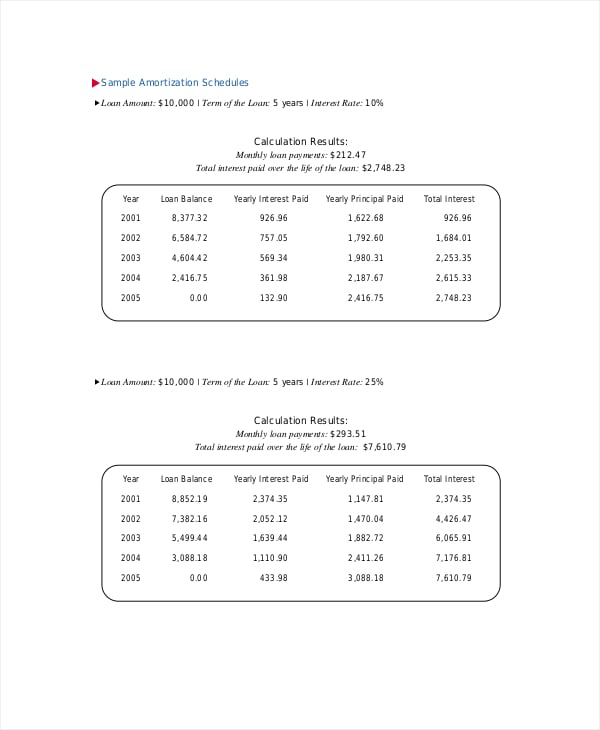

29 Amortization Schedule Templates Free Premium Templates

An additional 50 or even 25 extra principal each month may make a surprising difference.

. The multiple extra payments can be for 2 or any number up until the loan is paid-in-full. The extra payment options are a one-time extra payment recurring biweekly monthly quarterly. Number of Regular Payments.

It offers amortization charts extra payment options payment frequency adjustments and many other useful features. You can check the current mortgage rates here. The calculator lets you find out how your monthly.

This calculator figures monthly recreational vehicle loan payments. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. Calculate loan payment payoff time balloon.

Payment 35 95483 63215 32268 Aug-6-2025 Payment 36 95483 63107 32376. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Brets mortgageloan amortization schedule calculator.

Having such knowledge gives the borrower a better idea of how each payment affects a loan. Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. While the annual guarantee fee is 035 of the outstanding principal balance.

Rental price 70 per night. In some cases the second mortgage is an adjustable rate. Additional payments of 50 to 100 a month have the most impact during the early years of a loan.

Loan Sep-6-2022 Payment 1 95483 66667 28816. Interest rate is the annual interest rate of your mortgage loan given in percentage. In the early years of a longterm loan most of the payment is applied toward interest.

It also calculates the monthly payment amount and determines the portion of ones payment going to interest. The mortgage calculator with extra payments gives borrowers four ways to include extra payments for their payments in case they want to pay off their mortgage earlier. A mortgage usually includes the following key components.

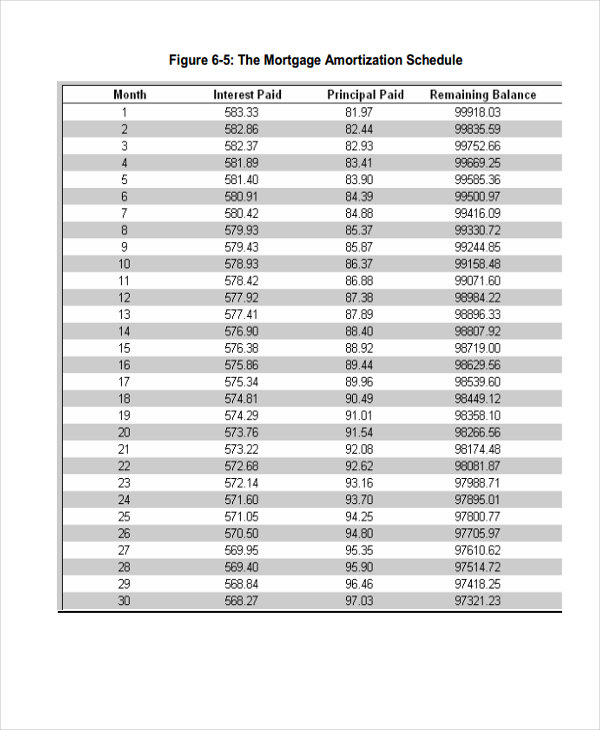

The mortgage amortization schedule shows how much in principal and interest is paid over time. How Do Biweekly Mortgage Payments Work. Bi-weekly payments help you pay off principal in an accelerated fashion before interest has a chance to compound on it.

A piggyback can be a first mortgage for 80 of the homes value and a second mortgage for 5 to 20 of value depending upon how much the borrower puts down as a payment. The calculation below shows how much of your mortgage principal will be left at the end of the term. See how those payments break down over your loan term with our amortization calculator.

Total Tax Insurance PMI and Fees. Mortgages are how most people are able to own homes in the US. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

The annual fee is also paid for the entire loan term. PMI typically costs from 035 to 078 of the loan balance per year. Using the following example lets assume each.

Will help you determine the best course of action is to think about the amount of pure interest paid on top of the principal loan amount. You can save on interest charges by making extra payments. Extra Payment Mortgage Calculator.

25 years for mortgages with down payments under 20 or 35 years for mortgages with larger down. Those who pay at least 20 on a home do not require PMI but homebuyers using a conventional mortgage with a loan-to-value LTV above 80 are usually required to pay PMI until the loan balance falls to 78. The loan is secured on the borrowers property through a process.

The second monthly payment budget calculator shows how expensive of a RV you can buy given a monthly. Use this calculator to compare the full cost of a loan with discount points to one without them. Theres a way to reduce your term without choosing a 15-year fixed-rate loan or refinancing.

This can be done by making extra mortgage payments toward your principal. This calculator will help you to determine the principal and interest breakdown on any given payment number. Use our Alberta mortgage calculator to determine your monthly mortgage payment for your home purchase in Alberta.

You can save a lot of interest if you pay down the loan earlyThis extra payment calculator is designed to tell you how much interest and time youll save if. Payments per year - defaults to 12 to calculate the monthly loan payment which amortizes over the specified period of years. However an increasingly common option is the 15 year balloon.

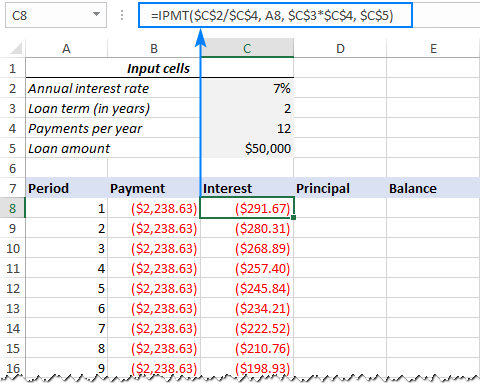

Complete this table with necessary formulas and fill everything down. Private Mortgage Insurance also known as Lenders Mortgage Insurance tends to be around 55 per month per 10000000 financed. See Brets Blog for help.

These are also the basic components of a mortgage. Closing Balance is opening balance minus principal paid minus extra payment. The RBA has increased interest rates by 50 basis points to 235 per cent Use our calculator to see how much extra your mortgage repayments will be The Reserve Bank of Australia has enacted a fifth.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. A Note on Private Mortgage Insurance. Extra Payment is the input column where we can type any extra payments.

Enter the loans original terms principal interest rate number of payments and monthly payment amount and well show how much of your current payment is applied to principal and interest. To help you see current market conditions and find a local lender current current Redmond RV loan rates and personal loan rates personal loan rates are published below the calculator. The extra payments help reduce the principal faster.

In that case set the number of extra payments to Unknown When the extra payments are off-schedule the calculator prepares an expanded amortization schedule showing the payment being applied 100 to the principal with interest accruing. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. Home buyers can shave years off their loan by paying bi-weekly making extra payments.

35 or even 40 years. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. Unsure if you should buy discount points on your mortgage.

This adds 5500 to your monthly payments. Try this free feature-rich mortgage calculator today.

29 Amortization Schedule Templates Free Premium Templates

How To Grow A Good Retirement Fund After Age 30 Quora

29 Amortization Schedule Templates Free Premium Templates

29 Amortization Schedule Templates Free Premium Templates

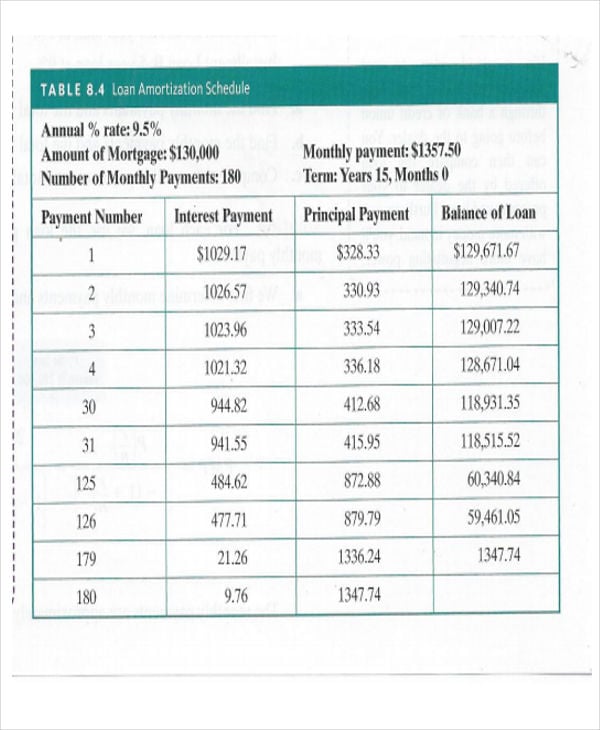

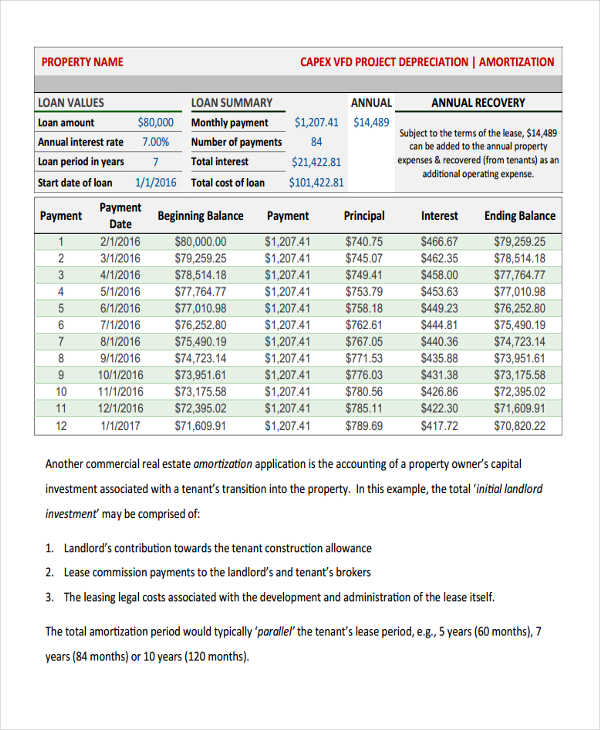

Tables To Calculate Loan Amortization Schedule Free Business Templates

Kenya Silver Ceramic Wall Tile 8 X 24 In Bathroom Remodel Master Bathroom Remodel Shower Small Bathroom Makeover

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Tables To Calculate Loan Amortization Schedule Free Business Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Tables To Calculate Loan Amortization Schedule Free Business Templates

29 Amortization Schedule Templates Free Premium Templates

Free Amortization Schedule Free Pdf Excel Documents Download Free Premium Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

29 Amortization Schedule Templates Free Premium Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed